A seamless integration: one platform, one training, and one application that meets the needs of both your patients and your office.

This unified approach not only simplifies operations but also enhances the quality of care.

It’s about efficiency and excellence, all in one platform.

DentiRate simplifies financing for patients and providers. We facilitate in-house financing and provide a wide range of tailored loan options for your patients

DentiRate bridges dental offices, patients, and lenders, creating a mutually beneficial ecosystem.

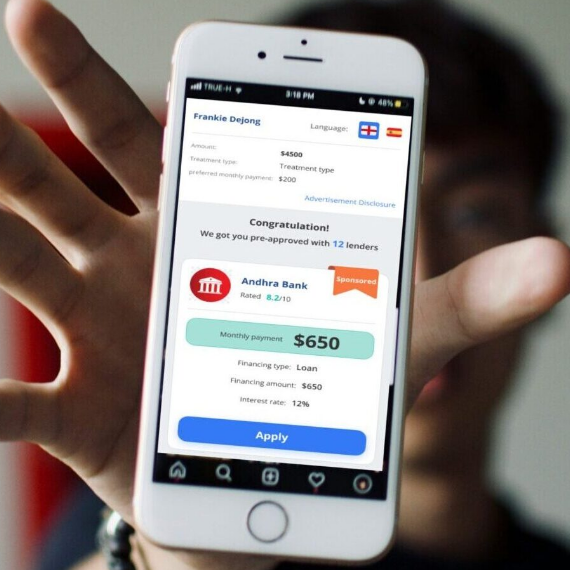

DentiRate matches patients with financing that fits their needs, regardless of financial condition. Enjoy a wide array of lenders, programs, APRs, and payment options. Enhance patient engagement with our state-of-the-art user experience.

Free your dental office from restrictive lender terms and choose the best options for your patients.

Dental Financing

Matters

By simplifying the financing process, DentiRate aims to ensure that dental offices can offer flexible financing options seamlessly, enhancing patient accessibility to essential dental treatments.

Efficiency

The streamlined process ensures that patients receive financing options and approvals swiftly, with minimal effort by provider.

Time Saving

The quick pre-approval process avoids unnecessary delays in treatment, ensuring timely access to necessary dental care within minutes.

Multiple Options

Without a lengthy and repetitious process, patients are provided with multiple uniquely personalized financing options, ensuring approval rates of over 95%.

Collaboration

DentiRate serves as a bridge between dental offices and lenders, fostering a collaborative ecosystem benefiting both, and offering patients a wide range of affordable options.

Patient-Centric

DentiRate prioritizes patients' needs, empowering them to make easy decisions that align with their preferences and financial situation.

DentiRate Advantage

Dental financing is more than just a financial transaction. It's about breaking down barriers to ensure that every patient can access the dental care they deserve. With DentiRate, dental offices gain the power to make treatments accessible, boost patient acceptance rates, and build lasting relationships.

Competitive Edge

Dental offices that provide financing gain a competitive advantage by offering a service that can differentiate them from other practices in the area.

Emergency Cases

Dental emergencies require swift action, and patients might not have the funds readily available. Dental financing ensures they can receive immediate treatment without delay.

Positive Patient Experience

Patient satisfaction increases when they have the flexibility to choose payment plans that suit their budget. This leads to a positive overall experience.

Business Growth

Offering financing can attract more patients, contributing to the growth of the dental practice. Satisfied patients are more likely to refer others to the practice.

Enhanced Treatment Plans

With financing options, dental offices can present more comprehensive treatment plans covering full dental needs, rather than only the affordable portion.

Partnership Opportunities

Dental offices can establish partnerships with lending institutions, leading to collaborative marketing efforts and potentially expanding the practice’s reach.

Practice Reputation

Providing financing options positions the dental office as patient-centric and attuned to patients’ financial realities, positively influencing its reputation in the community.

Strengthened Financial Health

By ensuring more predictable revenue streams through installment payments, dental offices can maintain better financial stability.

Community Impact

Dental financing contributes to the overall well-being of the community by making oral healthcare accessible to a wider range of individuals.

DentiRate Steps

How

DENTIRATE works

DentiRate Steps

How

DENTIRATE works

Login to

Dentrate Portal

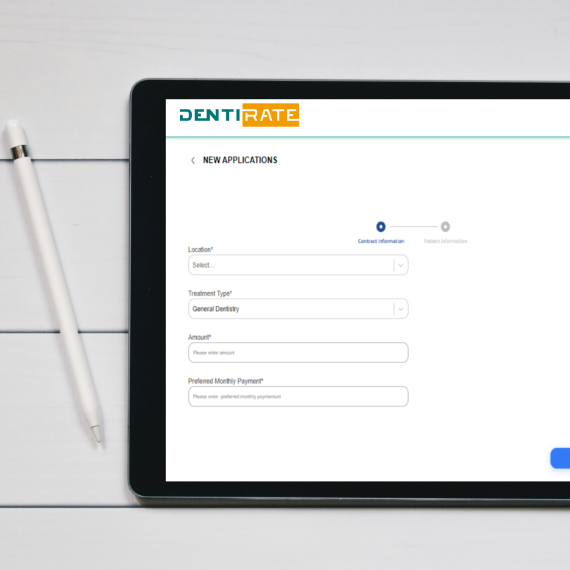

Patient Information &

Application Submission

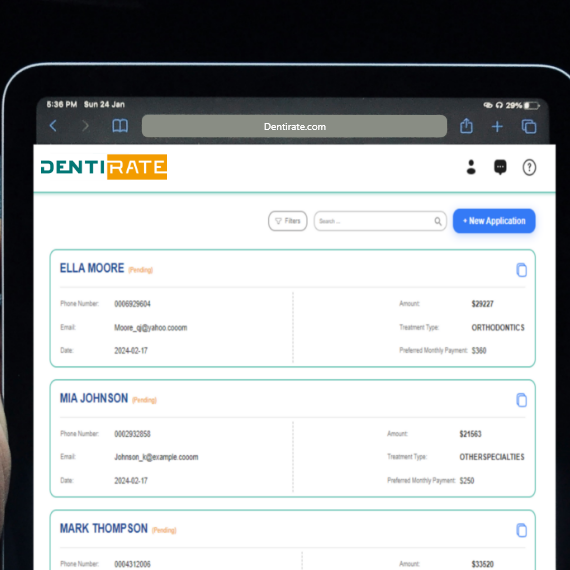

Application Review &

Pre-approval

Lender Responses &

Apply

Lets get started.

Lets get started.

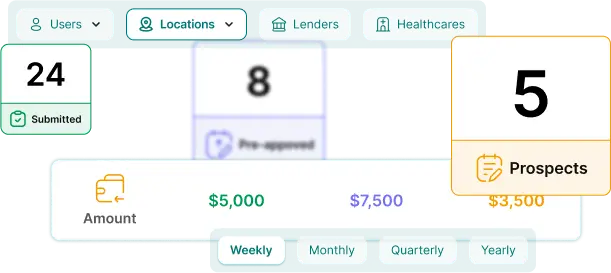

DENTIRATE

Analytics Dashboard

for Your

Dental Practice

At DentiRate, we've revolutionized the way dental offices manage their financial performance, focusing specifically on the revenue generated from our streamlined financing options. Our Analytics Dashboard empowers dental providers like you to track and optimize the financial aspects of your practice with ease.

Elevate Office Performance Management

Our reporting feature extends to providing comprehensive performance reports for each dental office under your umbrella. These insights enable you to distinguish top-performing offices and areas that may need nurturing.

Identify trends across time periods, recognizing peak financing intervals, favored treatments, and patient preferences. Leverage these insights to strategize effectively and optimize your services.

Use performance insights to identify gaps and capitalize on opportunities within your financing offerings. Tailor your approach to align with each office's unique requirements and patient expectations.

Armed with precise data, make decisions grounded in data-driven intelligence. Drive revenue growth and enhance patient care across your dental offices.

Elevate Office Performance Management

Our reporting feature extends to providing comprehensive performance reports for each dental office under your umbrella. These insights enable you to distinguish top-performing offices and areas that may need nurturing.

Our reporting feature extends to providing comprehensive performance reports for each dental office under your umbrella. These insights enable you to distinguish top-performing offices and areas that may need nurturing.

Our reporting feature extends to providing comprehensive performance reports for each dental office under your umbrella. These insights enable you to distinguish top-performing offices and areas that may need nurturing.

Our reporting feature extends to providing comprehensive performance reports for each dental office under your umbrella. These insights enable you to distinguish top-performing offices and areas that may need nurturing.